Management Information

Message from the President

I would like to express our sincere gratitude to our shareholders and investors for their exceptional support.

Thanks to your support, we, ShoEi Foods Corporation, could celebrate the 120th anniversary on November 3, 2024. We are truly grateful to our shareholders for their support and patronage, which has enabled us to continue our business for so long since our founding in 1904.

In terms of the general business environment surrounding us, while prices continue to rise due to labor shortages and the weak yen, incomes have stagnated, and the future remains uncertain. In the food industry, while sales increased due to price hikes reflecting an increase in costs, as consumer buying motivation declined, efforts to reduce costs continued, such as streamlining logistics. Under these circumstances, the ShoEi Foods Corporation Group steadily implemented measures aligned with its Medium-Term Management Plan, such as enhancing facilities to ensure the stable supply of safe and reliable products and strengthening collaboration with overseas suppliers.

As a result of these efforts, consolidated net sales for the 77th Fiscal Year ending October 2024 increased by 5.1% year on year to 115,208 million yen, thanks to increases in sales of dairy products and retail products in Japan, as well as an increase in sales in the overseas segment such as exports of inshell walnuts from the United States and sales of nuts and dried fruits in China. On the profit front, operating profit increased by 20.0% year on year to 4,844 million yen, ordinary profit increased by 19.6% to 4,950 million yen, and profit attributable to owners of parent increased by 12.8% to 3,170 million yen. This was owing to an improvement in profits in Japan due to the stabilization of the rise in energy cost and the progress of product price revisions, among others, despite lower profit from reduced margin of walnuts in the United States. The China segment also saw improved profitability in both exports and domestic sales.

Regarding the fiscal year ending October 2025 (the 78th fiscal year), new US President is due to take office in early 2025, and he has already announced the implementation of policies such as additional tariffs. This is expected to lead to increased inflationary pressure and fluctuations in exchange rates. The economic slowdown in China and geopolitical issues such as those in the Middle East and Ukraine are also expected to continue. Additionally, factors like climate change are likely to contribute to ongoing fluctuations in agricultural product prices. For these reasons, the economic environment surrounding the Group is expected to remain uncertain.

Under these circumstances, the Group aims to achieve sustainable growth by integrating three functions—stable procurement of high-quality raw ingredients, enhancing added value through processing capabilities, and strengthening our ability to respond to customer needs—and, at the same time, further refining each of these functions individually.

We look forward to your further support and guidance.

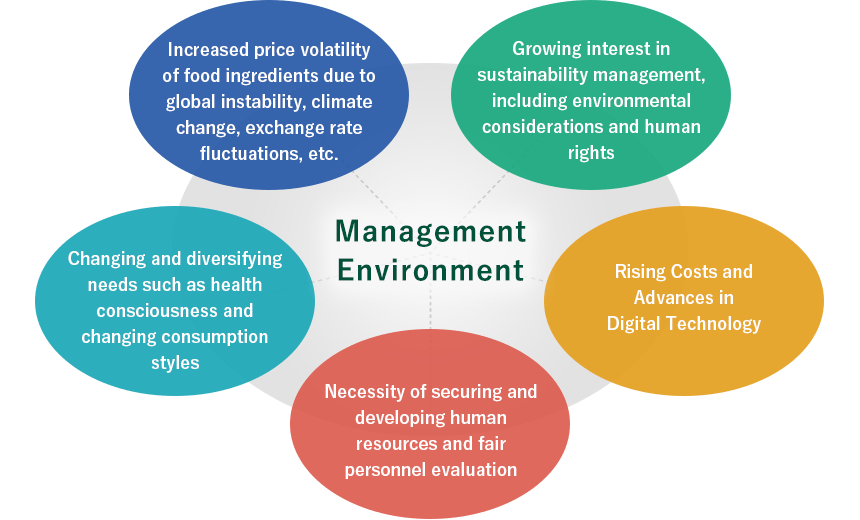

Management Environment & Management Strategy

We see the following five management environments that need to be addressed from a medium- to long-term perspective in particular, and have established basic management strategies to address these environments.

|

1. Growth strategy as a food trading company |

|---|

| ・ Cultivating growing industries and users |

| ・ Pioneering new fields |

| ・ Expansion of product lineup(Promote changes in the profit structure to increase profits) |

| ・ Strengthening global expansion |

| ・ Strengthening the supply chain for main products |

| 2. Growth strategy as a food manufacturer |

|---|

| ・ Product design tailored to customer needs and the accompanying capital investment |

| ・ Initiatives to improve factory utilization rates |

| ・ Efforts to provide safe and reliable food |

| 3. Promotion of Sustainability Management |

|---|

| ・ Promoting environmental responsiveness and human resource diversity |

| ・ Maintaining a sustainable logistics network |

| ・ Collaborating with Stakeholders |

| ・ Promotion of DX |

| ・ Strengthening the Corporate Governance System |

Management Objectives & Shareholder Return Policy

◆As for net sales, changes in local prices reflecting changes in crop yields and demand, and fluctuations in foreign exchange rates cause changes in the unit purchase prices of imported food materials, which in turn cause changes in selling prices. Therefore, as a management indicator, our main goal is to increase gross profit and operating income rather than net sales.

◆In addition, our policy is to aim for an ROE (return on equity) of 8% over the medium to long term in order to sustainably increase corporate value. Although it is currently below 8% due to aggressive capital investment such as new plant construction and the recording of depreciation and amortization expenses, we aim to achieve 8% over the medium to long term.

◆In terms of profit distribution,we regard the return of profits to shareholders as an important management issue and makes it a basic policy to maintain stable dividends and to pay dividends from surplus twice a year, once as an interim dividend and once as a year-end dividend, based on a comprehensive assessment of business investments to achieve medium- to long-term growth and the level of retained earnings. Our basic policy is to pay dividends twice a year, an interim dividend and a year-end dividend.

Business Risks

Risks with the potential to negatively affect the Group’s financial status and management results are as follows, and we see them as factors that may significantly impact investor decisions. Though the items below include future items, they were interpreted as of January 30, 2024, the day we submitted our securities report.

(1)Food safety

The Group sources products and ingredients from Japanese and overseas manufacturers and producers, and has production subsidiaries in Japan, the US, and China. We endeavor to enhance quality management and secure food safety by measures such as holding regular meetings with participants from the Quality Assurance Department and plants both in Japan and overseas. However, unpredictable issues and accidents in the manufacturing or processing lines could cause large-scale product recalls or large product-liability costs that would affect the Group’s financial status and management results.

(2)Inventory

The Group handles a wide variety of food ingredients and products. In particular, we maintain a certain amount of inventory centering on imported ingredients and products. We focus on inventory management to ensure we carry no excess inventory or expired product, by carefully taking into account harvest timing for agricultural products, production schedules at each plant, shipping schedules to our clients, and food expiry dates, as well as by assigning a person-in-charge for each product, who conducts frequent information exchanges with sales representatives. However, stock disposal due to disparity between sales forecasts and actual results, as well as substantial price fluctuations, could affect the Group’s financial status and management results.

(3)Stable procurement of food ingredients and their rising prices

As the Group sources food ingredients and products in and outside Japan, we face risks such as poor harvests due to natural disasters and climate change, which makes it difficult to secure consistent quality and quantity. We also face the possibility of our purchase and production costs being greatly affected by fluctuations in the overseas market prices of agricultural products due to changes in demand, or by exchange rate fluctuations. To counteract the above, we assign a procurement person-in-charge for each product, and strive to secure a consistent supply by conducting frequent information exchanges with each supplier and verifying the conditions of crops. However, if fluctuations occur on an unpredictable scale, the quality of ingredients and products may be compromised, or shortages may occur, which could impact the Group’s financial status and management results.

(4)Epidemics of communicable diseases or natural disasters

On top of sales offices, the Group also promotes its business through production plants and such. While the Group strives to control risks by such efforts as regularly reviewing the business continuity plan (BCP) and utilizing insurance, unpredictable natural disasters such as large earthquakes and extensive fires could cause loss or damage to the Group’s facilities and plants. In addition, large-scale epidemics of communicable diseases could damage our product supply which rely on ordering and shipping activities, and our production activities which rely on plants, thus affecting the Group’s financial status and management results.

(5)Impact of business globalization

The Group sources a portion of food ingredients and products from overseas, and operates production bases and sales businesses overseas. While the Group aims to manage related risks by designating departments dedicated to overseas procurements and a department to the management of overseas Group companies, wars, terrorism, political or social unrest, disadvantageous taxation and regulations, their amendments and abolition, and other unpredictable circumstances, or a defect in the governance of an overseas Group company, may affect the Group’s financial status and management results.

(6)Trade credit risks

The Group has experienced credit risks owing to accounts receivable of trade partners. We work to prevent credit risks by setting credit limits for each partner based on credit analyses and reviewing the partner based on the approval authority reflecting the credit limit. However, uncollected debts arising from unpredictable circumstances such as bankruptcy of our trade partners could affect the Group’s financial status and management results.

(7)Compliance with legal regulations, etc.

Our business activities are regulated in Japan by laws such as the Food Safety Basic Act and Food Sanitation Act, and in other countries where we conduct businesses by similar legal regulations. Although we have laid out appropriate measures to comply with these regulations, changes in these regulations or receiving a violation warning could limit the Group’s business activities and adversely affect our financial status and management results.

(8)Information and systems

On the back of the advancement of digitalization, besides order, purchase and accounting processing being conducted via information communications and data processing, communication with business partners, information exchanges within the Company, etc. also utilize electronic exchange methods. Therefore, the Group strives to reduce related risks by designating a department dedicated to information systems. However, if an information leakage, data loss, or virus attack occurs, the Group’s corporate activities may be hindered, which may affect the Group’s financial status and management results.

(9)Risks Related to Domestic and International Transportation

In response to labor shortages in the logistics industry, the Group is promoting a modal shift from trucking to rail freight and other modes of transportation, as well as unloading imported cargo at ports close to consumption centers. However, if problems arise, such as delays in product delivery due to a shortage of delivery drivers or a significant increase in logistics costs due to soaring labor and fuel costs, our group's business results may be affected. In addition, the increasing instability in global marine transportation may cause delays in the procurement of products and increases in logistics costs, which may affect the financial position and business performance of the Group.

Corporate Governance

Our Corporate Governance

Our basic approach to corporate governance The Group’s corporate philosophy is to "create a new food culture and contribute to society by consistently providing our customers with safe and reliable food products carefully sourced from domestic and overseas suppliers." To achieve this philosophy, it is important that we continue to exist as a company trusted by our shareholders and all stakeholders of the society, by ensuring healthy management with high transparency. Aiming for sustainable growth and improving our mid- to long-term corporate value, we will work to improve our corporate governance and build and operate a system to monitor and control our business activities.

Organization Chart of Corporate Governance